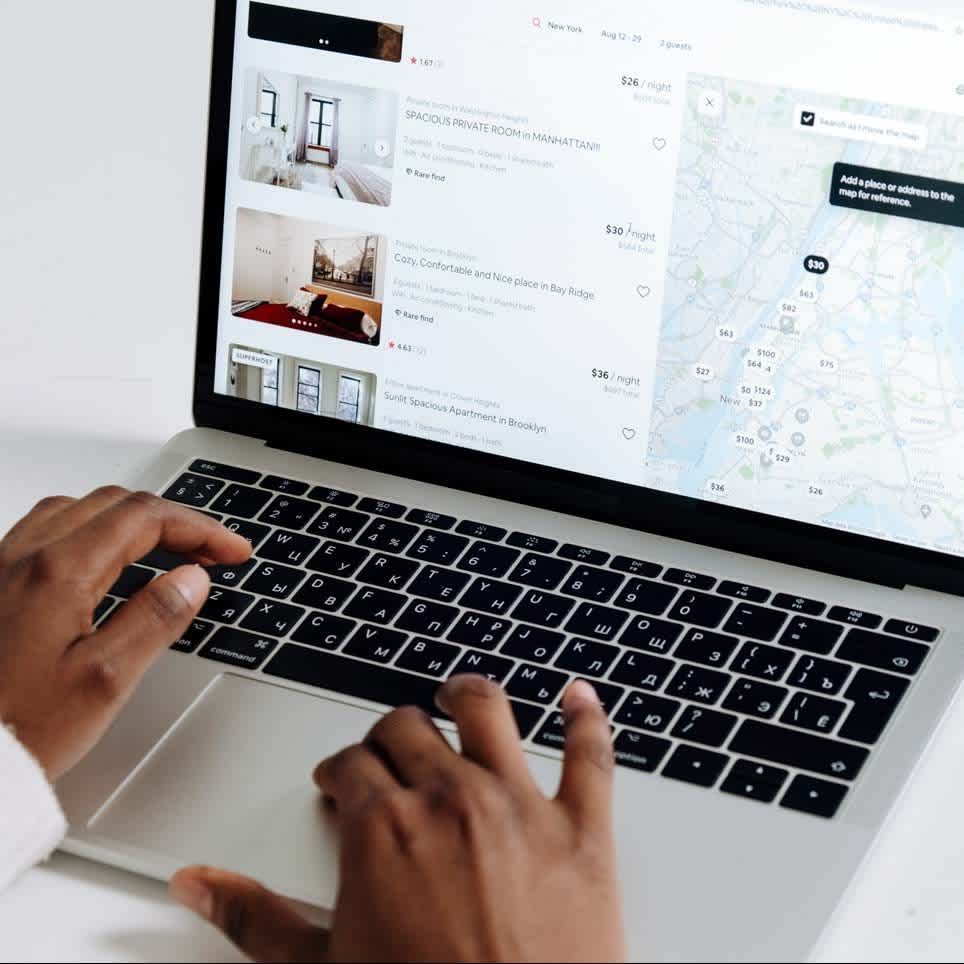

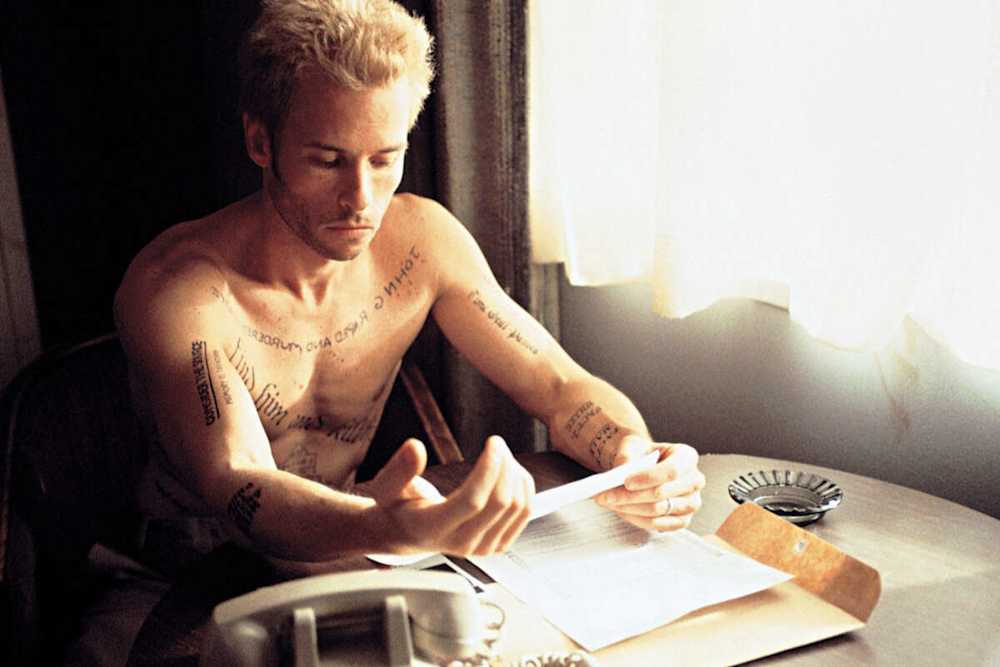

Airbnb taxation decoded for those still trying to put 'Memento's scenes in order.

Understanding Airbnb taxation can sometimes feel as bewildering as following the plot of Memento, Christopher Nolan's famous film where reality is fragmented and chronology upended. Just like Leonard Shelby, the protagonist who must piece together a puzzle to uncover the truth, Airbnb owners often find themselves navigating a maze of tax regulations, deductions, and declarations, desperately trying to make sense of their fiscal situation. Fear not, this article is here to simplify Airbnb taxation, no need for memorial tattoos or Polaroids. Prepare to demystify tax complexities with the same ease as if you were following the linear storyline of a classic film, far from Nolan's twists and temporal reversals.

Fundamentals of Airbnb taxation.

Short-term rentals, especially through platforms like Airbnb, have become a favored source of income for many owners worldwide. However, navigating the sometimes murky waters of the taxation associated with these revenues can prove complex. This chapter aims to demystify the basic principles of furnished rental taxation, focusing on the tax regimes in France, the available deductions, and exemptions.

Introduction to the taxation of furnished rentals

The taxation of furnished rentals in France is governed by specific rules that classify these revenues in the category of industrial and commercial profits (BIC). Whether you are an owner or a tenant making a property available on Airbnb, you are required to declare the rents received to the tax administration. This obligation remains, regardless of the amount generated, from the first euro received. To learn more, visit the official tax website.

Understanding tax regimes

The tax regime applicable to your Airbnb income essentially depends on the annual amount generated.

The micro-BIC regime is automatically applied for annual revenues below €70,000. This regime offers a flat-rate deduction of 50%, representing the expenses related to the rental activity. Thus, if Elena, an owner of an apartment in Paris, generates €30,000 in annual revenues via Airbnb, she benefits from a deduction of €15,000. Her taxable income thus amounts to €15,000, on which social contributions (17.2%) and income tax according to her marginal tax bracket will apply.

The real regime applies when revenues exceed the threshold of €70,000 or at the option of the lessor, even below this threshold. This regime allows for the deduction of actual and justified expenses related to the rental activity, potentially offering a lower taxable base. However, it requires detailed accounting and the preservation of expense receipts.

Concrete example of Elena

Micro-BIC Regime

Annual revenues: €30,000

50% deduction (applicable under the micro-BIC regime): €30,000 * 50% = €15,000

Taxable income: €15,000

Income Tax Calculation:

Taxable income: €15,000

30% tax rate: €15,000 * 30% = €4,500

Social Contributions Calculation:

Taxable income: €15,000

17.2% rate of social contributions: €15,000 * 17.2% = €2,580

Total taxes and social contributions to be paid: €4,500 + €2,580 = €7,080

Real Regime

Under the real regime, Elena can deduct her actual expenses. Let's assume she has the following expenses:

Concierge fees: €5,000

Accounting fees: €1,000

Other charges (electricity, water, internet, insurance, etc.): €3,000

Total deductible expenses: €5,000 + €1,000 + €3,000 = €9,000

Annual revenues: €30,000

Total deductible expenses: €9,000

Taxable income after deduction of expenses: €30,000 - €9,000 = €21,000

Income Tax Calculation:

Taxable income after deduction: €21,000

30% tax rate: €21,000 * 30% = €6,300

Social Contributions Calculation:

Taxable income after deduction: €21,000

17.2% rate of social contributions: €21,000 * 17.2% = €3,612

Total taxes and social contributions to be paid under the real regime: €6,300 + €3,612 = €9,912

Result

Opting for the micro-BIC regime, Elena would have to pay €7,080 in taxes and social contributions. Under the real regime, with the specific deductions mentioned, she would have to pay €9,912. This illustrates the importance of choosing the right tax regime based on your personal situation and actual deductible expenses, as in this example, the micro-BIC regime proves to be more advantageous for Elena.

Deductions and exemptions

Besides the tax regimes, certain deductions and exemptions may apply under conditions.

Exemption for low incomes: Owners generating less than €305 in annual revenues are exempt from tax.

Renting out the principal residence: Revenues from renting out a part of the principal residence are exempt from tax up to €760 per year.

Classified furnished tourist accommodations: These properties benefit from a flat-rate deduction of 71% on the rents collected up to €170,000 per year.

The taxation of furnished rentals via Airbnb may seem intimidating at first glance. However, a clear understanding of the tax regimes, deductions, and exemptions available allows owners to comply with their obligations while optimizing their tax burden. Whether you opt for the micro-BIC regime or the real regime, the essential thing is to document your income and expenses well and stay informed of legislative developments that could impact your tax situation. For optimal management, do not hesitate to consult a professional or use the services of a specialized concierge service.

How to declare your Airbnb income?

Declaring income from renting via Airbnb is a crucial step for any owner. It ensures compliance with tax obligations and helps avoid penalties. This chapter guides you through the different stages of the declaration, from automatic transmission by Airbnb to the specifics of ticking boxes, and highlights the importance of support from an accountant.

Automatic Transmissions from Airbnb

Since 2020, Airbnb has been required to transmit to the French tax administration the income earned by its users, thus facilitating the declaration process for hosts. For users generating more than €1,000 on the platform, identity verification is required. Gross income, including the rental price, cleaning fees, and host service fees, is accessible via a CSV file downloadable from your Airbnb user space. This automation aims to simplify the declaration of rental income while ensuring greater transparency with the tax administration.

Which Boxes to Tick?

When declaring your Airbnb income, the choice of tax regime is crucial. For revenues below €77,700 per year, the micro-BIC regime is often the most advantageous, allowing for a 50% flat-rate deduction on gross income. Income must be declared in box 5ND for the person receiving the rental income. For those opting for the real regime, due to annual rental income exceeding or for a more advantageous deduction of actual expenses, form 2031 SD must be used. This choice should be evaluated based on your specific situation, considering deductible expenses and the flat-rate deduction (source).

Hiring an Accountant

Although an accountant is not mandatory for owners opting for the micro-BIC regime, their intervention becomes crucial for those choosing the real regime. Furnished rental under the real regime requires precise accounting, including maintaining a simplified balance sheet, an income statement, and the result declaration via Cerfa form 2031, among others. The accountant assists you in these procedures, ensures the compliance of your declarations, and optimizes your tax situation. The feesof an accountant, although variable, represent a wise investment for securing and optimizing the fiscal management of your rental property. Moreover, a tax reduction of 66% of the fees paid to the accountant is possible, up to €915, under certain conditions.

Declaring Airbnb income requires careful attention to detail and a good understanding of the available tax options. The automatic transmission of income by Airbnb simplifies part of the process, but selecting the appropriate tax regime and correctly filling out the tax forms remain crucial. The support of an accountant, especially for those opting for the real regime, is strongly recommended to navigate confidently through the complex tax landscape of furnished rentals.

"Loi Finance 2024": much ado about nothing.

The Finance Law for 2024 has sparked strong reactions, particularly due to changes made to the tax deduction on furnished tourist rentals, such as Airbnb. However, a recent government decision seems to temporarily pause these changes, leaving owners in a situation of uncertainty but with an unexpected opportunity.

At the origin of the controversy

Last fall, an amendment adopted in the 2024 budget, initiated by senators from various political backgrounds, reduced the tax deduction on furnished tourist rentals to 30% instead of 71% in tense areas. This decision, aimed at aligning the taxation of furnished tourist rentals on a more equitable basis, was adopted despite the government's preference for a 50% deduction rate. In the legislative turmoil, this article was mistakenly passed.

The government's response

Faced with this situation, the government announced its intention to "correct" this error, potentially through a rectifying finance law. However, a simpler solution was found: a note from the Official Bulletin of Public Finances recently published allows taxpayers to use the previous rate for 2023 revenues, despite the Finance Law. This note enables concerned taxpayers to apply the provisions prior to the Finance Law for 2024 to their 2023 revenues, thus giving them the freedom to act as if this new law did not exist for the time being. This temporary decision suggests that the next Finance Law, for 2025, could cancel the mistake made.

Reactions and consequences

This unexpected freedom granted to owners of furnished tourist accommodations has elicited mixed reactions. On one hand, the Umih (Union of Trades and Hospitality Industries) expresses its incomprehension and regrets that the advances obtained in the Senate do not apply to 2023 revenues, allowing owners to opt for a more favorable tax regime. On the other hand, this decision is contested by Communist Senator Ian Brossat, who has already initiated an appeal before the Council of State. This situation illustrates the complexity and challenges associated with regulating the taxation of furnished tourist rentals, in a context of an exacerbated housing crisis.

Although the Finance Law for 2024 initially introduced significant changes in the taxation of furnished tourist rentals, a recent government note offers taxpayers a temporary pause. This decision, although controversial, highlights the difficulties of implementing fiscal policies in a rapidly evolving sector. Furnished tourist rental owners thus find themselves in a waiting position, hoping that future clarifications will provide them with a more stable direction.

The role of the concierge service in all this?

In the fluctuating context of the taxation of furnished tourist rentals, the role of a concierge service becomes more relevant than ever. Hoterie, as a leader in the management of seasonal rental properties, offers a range of services designed to maximize owners' profitability while ensuring flawless management and an exceptional customer experience.

Reinventing property management

Hoterie stands out for its ability to transform real estate properties into top-choice rentals. Our comprehensive service includes enhancing each property with artistic photography, writing elegant ads, and refined communication with travelers. By adopting a dynamic pricing strategy and providing excellent services, from housekeeping to laundry, to personalized guest welcomes, Hoterie aims to redefine the seasonal rental industry.

The concierge service's role regarding owners' taxation.

Although the concierge service does not replace the advice of an accountant, it plays a crucial role in simplifying the fiscal management of owners. By providing accurate documentation and sources on the generated income and associated rental expenses, Hoterie facilitates the tax declaration process for owners. This meticulous documentation is essential for optimizing tax declarations and potentially maximizing available tax deductions.

Assistance and advice

Hoterie also offers assistance in tax regulation, informing owners of the latest legislative and fiscal developments that could affect their rental. While we do not provide direct tax advice, our expertise in property management allows us to guide owners to the right resources and help them understand the potential impact on their investment.

Maximizing profitability

By optimizing the visibility and attractiveness of ads, dynamically adjusting rates based on the market, and ensuring high-quality customer experiences, Hoterie helps owners maximize their rental income. These optimized revenues, properly documented, facilitate tax declaration and contribute to better tax planning.

Strategic partnership

Ultimately, partnering with Hoterie represents much more than mere property management. It is a strategic collaboration aimed at maximizing profitability while confidently navigating the tax landscape of seasonal rentals. Our commitment to excellence and customer satisfaction makes us the ideal partner for owners looking to get the most out of their real estate investment.

In an environment where the taxation of furnished tourist rentals is constantly evolving, partnering with a concierge service like Hoterie can offer owners peace of mind and the certainty that their property is optimally managed, both from a customer experience and fiscal profitability perspective.

Last words.

In conclusion, navigating through the intricacies of Airbnb taxation, while staying compliant with legal obligations, can seem as complex as deciphering a Christopher Nolan screenplay. However, armed with the right information and perhaps the assistance of a competent concierge service, owners can not only simplify this process but also optimize their tax situation. Like in Memento, where each piece of the puzzle eventually finds its place, understanding the nuances of short-term rental taxation allows building a profitable and serene strategy. Thus, even without resorting to extreme mnemonic methods, you can ensure that your Airbnb venture remains profitable and compliant, leaving you free to focus on what truly matters: providing an exceptional experience for your travelers.